March 8, 2019 / 08:52

In the last quarter of 2018, the Agora Group increased its revenues – mainly due to the over 20-percent rise in cinema inflows owing to a record high attendance at cinemas and consistent expansion of the Helios network. Additionally, the Group's revenues from the copy sales were higher yoy, despite the hostile market trends. As a result Agora improved its financial performance, closing the entire year 2018 with a net profit.

– The year 2018, successful for the Agora Group – with record results in many businesses, gives us a great prospects on the execution of further development projects. In accordance with the current business strategy, we aim to strengthen our strongest existing ventures. We are focused on the premium offer and new technologies – as in the case of the Helios Dream concept, the digital subscriptions of Wyborcza.pl and Premium TOK FM, as well as the offer of AMS and Yieldbird. We are also boldly entering new markets – in 2019 we will develop our food service activities even faster under Papa Diego, Van Dog and Pasibus brands – comments Bartosz Hojka, the CEO of Agora.

In the 4Q 2018 total revenues of the Agora Group reached PLN 346.1 million and were 4.8% higher yoy. Thanks to the consecutive annual record in cinema attendance and the development of the Helios network, the Group noted significant increase of revenues from the admissions – by 20.4% to PLN 80.2 million and from cinema concession sales – by 26.7% to PLN 31.3 million. From October to December 2018, over 4.5 million tickets were purchased in Helios multiplexes, which is 24.6% more than last year, and nearly 18.9 million tickets sold in the entire cinema market in Poland – an increase of 15.5%.1 Additionally, the Group’s copy sales revenues were higher by 4.9% yoy and amounted to PLN 36.2 million, resulting from the increased copy price of Gazeta Wyborcza, as well as higher proceeds from the sale of digital content at Wyborcza.pl.

On the other hand, the revenues from the sale of Agora’s advertising services decreased in 4Q 2018 by 1.8% yoy to PLN 165.2 million. They were lower in the Press segment, as well as – slightly – in the Movies and Book and the Internet segments, while they grew yoy in the Outdoor and the Radio segments. It is worth noting that in the case of the Press segment, the dynamics of the segment's advertising revenues, apart from market trends, were affected by lower circulation of Gazeta Wyborcza and discontinuation of publishing of some press titles. The Agora Group recorded also lower proceeds from the sale of printing services, mainly as a result of a fall in volume of orders in the coldset technology and from other sales due to lower revenues from film distribution.

The operating costs of the Agora Group in the 4Q 2018 were significantly lower yoy – by 18.1%, amounting to PLN 331.4 million. This was related to a significant impairment of assets (PLN 88.9 million), which in the 4Q 2017 burdened the results of the Print, Internet and Press segments, affecting data comparability also for the entire Group. Impairment losses on assets and write-downs of receivables made in the last quarter of 2018 amounted to PLN 14.1 million. Additionally, depreciation costs have decreased over the period. The largest cost item in the Agora Group's results were expenses for external services, which increased by 4.0% to PLN 127.3 million, mainly due to higher costs of film copy purchase at Helios cinemas and higher costs of rent and lease fees, with lower costs of the Group's film business. The increase in the costs of materials and energy consumption and the value of goods and materials sold resulted mainly from higher cinema concession sales and higher costs of production services in the Print segment, while the cost of promotion and marketing grew in connection with the Group's radio brands’ intensified promotional activity and higher costs of completed commercial and sponsorship campaigns in the Outdoor segment. The staff costs in the entire Agora Group remained flat yoy, while growing the most in the Movies and Books segment – as a result of expansion of the Helios network and increase in the minimum hourly rate since the beginning of 2018. The decrease in this cost item took place in the Press, the Print and the Internet segmets, mainly due to the reduction of FTEs.

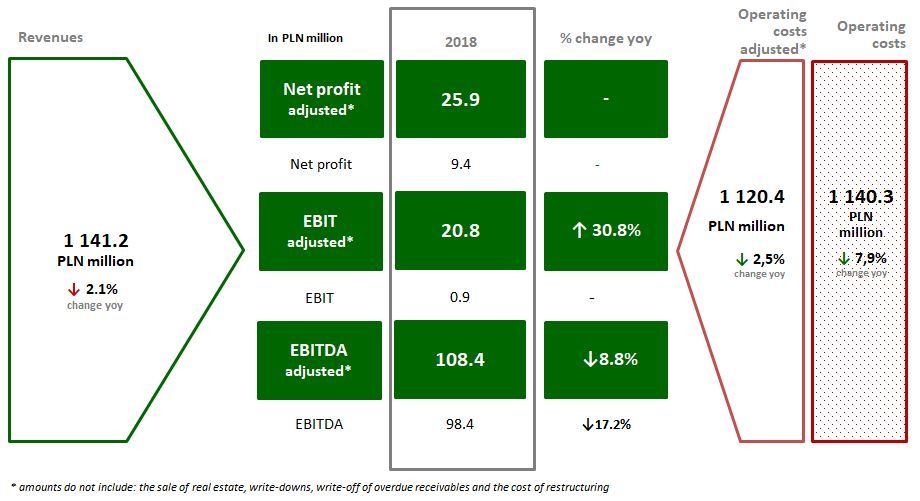

Due to higher revenues and reduced costs, with one–off events excluded,2 the results of the Agora Group were better than last year – EBIT amounted to PLN 28.8 million in the 4Q 2018 and PLN 20.8 million in 2018, while net profit excluding one-off events amounted to PLN 13.9 million in the 4Q 2018 and PLN 25.9 million in the entire 2018.3

The Agora Group is working intensively on the execution of development projects planned for 2018–2022. Its goal is to strengthen the position of the Helios cinema network, which is expanding with new facilities and plans to open the next ones, at the same time further developing the concept of premium screenings rooms under the name Helios Dream. In February 2019, the first Helios multiplex in Warsaw was opened – in the Blue City shopping mall. In 4Q 2018 the Agora Group's restaurant business was also launched – Foodio Concepts company, founded by the Helios network together with partners in March last year, opened in November in Katowice the first Papa Diego restaurant with a distinctive Mexican cuisine. The next ones were opened at the end of the year in Gdansk and Poznan.

In the Press segment, the Gazeta Wyborcza’s team succeeded in developing its paid digital subscription offer – at the end of 2018, the number of digital subscriptions totalled 170.5 thousand. This confirms the efficiency of the digital offer and the Gazeta Wyborcza’s position as the leader of premium content in the subscription model. Radio TOK FM is also developing the premium offer – in 2018 its team introduced a completely new application available for mobile devices with iOS and Android operating systems, and the number of subscriptions to its premium offer stood at 15.5 thou. at the end of last year. On the other hand, the AMS and Yieldbird companies have expanded their portfolio for clients. The first of them focuses on premium panels and digital solutions in outdoor segment, including AMS’ won tender for the lease of citylights in Wroclaw, while the second – Yieldbird – developed a product offered in the SaaS model addressed to a completely new group of customers.

In reference to the strategic plans of the Company for 2018–2022, which also assume strengthening the Group's position in its current areas of operations, in February 2019 Agora acquired a minority share in Eurozet Sp. z o.o. (40%), guaranteeing itself the possibility of taking up all shares if it proves to be beneficial in the future. The scale of food service activities, undertaken as part of the Helios group, is increasing – Foodio Concepts is planning to open approximately 20 new establishments under the Papa Diego and Van Dog brands in 2019. Additionally, Helios and its partners plan to develop together eateries with burgers under the Pasibus brand, increasing the scale of operations on food market.

Data source: consolidated financial statements according to IFRS, 4Q2018 and 2018.

Footnotes:

1 Ticket sales data are estimates of the Helios group according to Boxoffice.pl data that is based on data provided from film distributors. The sale of cinema tickets is reported in periods that are not identical to the calendar month, quarter or year. The number of tickets sold in a given period is measured from the first Friday of a given month, quarter or year to the first Thursday in the following month, quarter or reporting year.

2 Recognition without all one-time events, i.e.: sale of real estate, write-downs, write-off of overdue receivables and restructuring costs.

3 Including all one-off events in the 4Q2018, the Agora Group recorded a profit at the EBIT level of PLN 14.7 million, and in 2018 – PLN 0.9 million, while the Group's EBITDA increased to PLN 47.5 million., and in 2018 it was lower than a year before and amounted to PLN 98.4 million. The Group's net profit in the 4Q2018 amounted to PLN 2.3 million, and in the entire 2018 it was PLN 9.4 million. Net profit attributable to equity holders of the parent amounted to PLN 0.3 million in the 4Q2018 and PLN 5.1 million in 2018. From the 4Q2017, the EBITDA ratio, which was defined by the Company so far as EBIT increased by depreciation, it does not include costs of impairment losses on property, plant and equipment and intangible assets.

Go back