March 25, 2022 / 07:31

In the 4Q2021, the Agora Group focused on intensive rebuilding the results of its businesses. This was favored by the higher than market growth of the Group's advertising revenues and the rapidly growing inflows from cinema operations - tickets and concession sales, noted despite the pandemic related restrictions. As a result, the Agora Group ended the last quarter of 2021 with an increase in all levels of operating results - EBIT and EBITDA, and the Group's net profit reached over PLN 24 million.

- 2021 was yet another year of unprecedented challenges. Thanks to the flexibility and commitment of our team, we systematically rebuilt the financial results of the Agora Group, which in the 4Q were similar to those before the outbreak of the pandemic. Despite the radical limitation of investments, we also developed digital projects of key importance to us - says Bartosz Hojka, President of the Management Board of Agora.

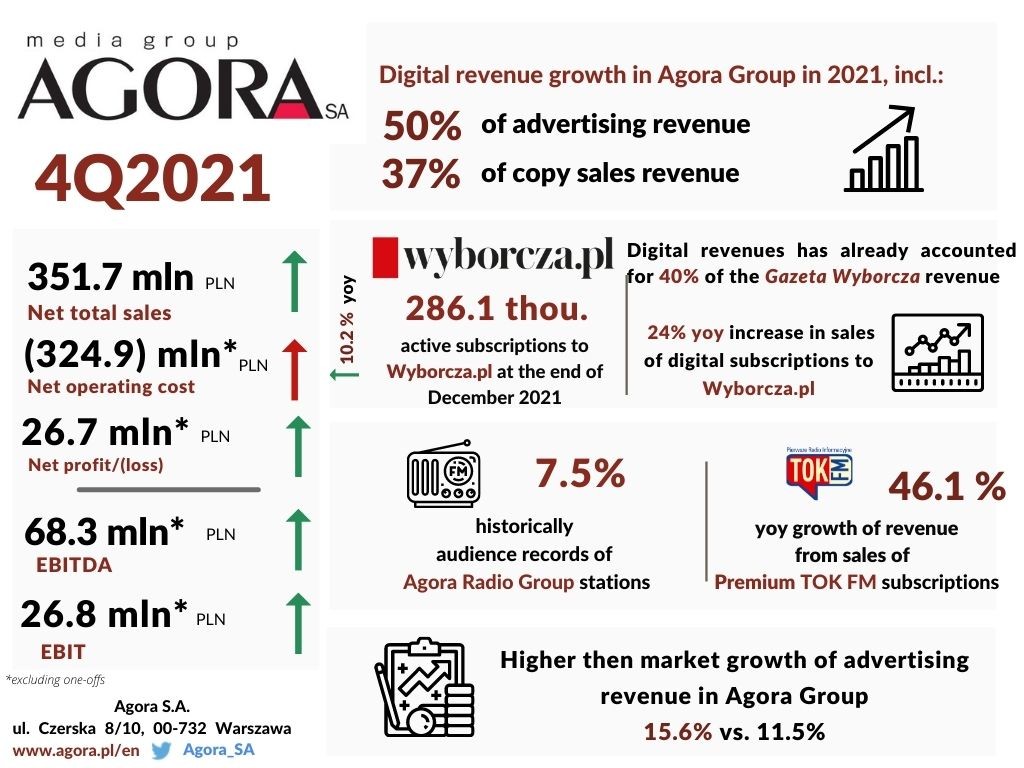

The total revenues of the Agora Group increased in 4Q2021 by as much as nearly 57.0% yoy and accounted for PLN 351.7 million. This was due to the intensive rebuilding of revenues from cinema activities, achieved despite the administrative restrictions on the functioning of cinemas, in force in connection with the next wave of COVID-19 pandemic. Despite the restrictions, the number of premieres on big screens was higher than in the previous year, which contributed to an over eightfold increase in both ticket and concession sales. In the period under discussion, over 3.4 million tickets were purchased in the Helios facilities, which is almost nine times more than last year - however, it must be remembered that in 2020 cinemas all over Poland were closed from 7 November. According to the Helios’ estimates, the total number of tickets sold for films introduced to Polish cinemas in the last quarter of 2021 was significantly higher than in 2020 and amounted to 14.8 million, which means an increase by over 846.0%*.

Due to the growth in all operating segments, the Agora Group's revenues from the advertising sales increased by almost 16.0% to PLN 174.9 million. This surge was higher than that observed on the market - in the 4Q2021 the total value of advertising expenditure in Poland increased by 11.5%**. The advertising sales grew the most in the Outdoor segment, mainly due to the high dynamics of revenues from campaigns carried out on premium citylight, digital, backlight and public transport panels. The advertising inflows of cinemas also grew intensively, and the ad sales of the Radio increased three times faster than the market ones.

The copy sales increased by over 9.0% yoy, mainly due to higher revenues from the sale of Agora Publishing House publications and sale of accesses to Wyborcza.pl digital content, which compensated for the decline in the sale of paper editions of the daily. At the end of December 2021, the number of digital subscriptions to Gazeta Wyborcza reached over 286 thou., and the share of revenues from this form of content sales in its total revenues accounted for nearly 40.0%. The inflows from the Premium TOK FM subscription also increased, the number of which at the end of 2021 reached nearly 26.2 thou. The Group also recorded higher income from other sales, as well as from film and catering activities.

Importantly, the digital revenues of the entire Agora Group are systematically growing - the digital and internet inflows of the Group increased by 24.0% in 2021. In the past 12 months, digital was the source of half of the Group's advertising sales, 37.0% of revenues from the content sales and 44.0% of revenues from the sale of tickets to the Helios cinemas.

The net operating costs of the Agora Group increased in the 4Q2021 by almost 27.0% to PLN 327.7 million. Their growth, recorded in all segments, was related to the increasingly intense activity of the Group's businesses, especially the cinema business, which was closed again a year ago at the end of 2020. The expences on external services, staff costs, costs of materials and energy consumption and the value of goods and materials sold, as well as expenditure on marketing and promotion where among the cost categories that increased in 4Q2021, while they remained at a low level a year ago due to restrictions in the operation of many areas of the Group or cost saving measures. At the same time, it is worth noting that the comparability of costs and operating results in the 4Q2020 and 4Q2021 was influenced by several one-off events, although in the period October - December last year their impact was much smaller***.

Thanks to the gradual adaptation to functioning in pandemic conditions and smaller scale of restrictions in business operations, and at the same time intensive work on rebuilding revenues, the Agora Group noted a significant improvement in financial results in the 4Q2021. The Group's profit at the EBITDA level increased by as much as 330.4% and stood at PLN 68.0 million, and at the EBIT level reached PLN 24.0 million. The net profit of the Agora Group in the 4Q2021 amounted to PLN 24.2 million****.

Based on the available market data, Agora estimates that the value of the advertising market in Poland in 2022 will increase as compared to 2021 by approximately 4.5%–6.5%.

The Management Board of the company initiated the process of creating the development strategy of the Agora Group for the years 2023 - 2027. However - with the future and development of the entire Group in mind - it has already announced that it will focus on rebuilding its results and doubling the value of investments concentrated on strengthening the most important businesses, especially building their flexibility and resilience to rapid changes in the market environment. In the case of the Helios cinema network and AMS in 2021, the Agora Group plans both replacement and development investments. Additionally, an important project, crucial for further development in digital, will be the revitalization of technological areas in the Group. In terms of acquisitions, Agora still plans to acquire all shares in Eurozet.

All these projects may be slowed down by market conditions, including high inflation, rising prices of goods and services, wage pressure and structural changes in the media and advertising market, as well as economic and other consequences related to Russia's attack on Ukraine.

Data source: consolidated financial statements for 2021 according to IFRS.

Footnotes:

* Cinema attendance: Agora's estimates - since November 2019, the UIP distributor has not reported attendance data for its films in Poland.

** Advertising market - Agora's estimates (press based on Kantar Media and Agora's monitoring, radio based on Kantar Media), IGRZ (outdoor advertising, the number of entities reporting revenues to IGRZ has decreased since January 2014), as well as preliminary data from Publicis Media (TV, cinema, internet).

*** One-off events in the 4Q2021 charged the operating costs of the Agora Group in the amount of PLN 2.8 million, while in 4Q2020 - PLN 7.1 million (detailed data available in the financial statements of the Agora Group for 2021according to IFRS).

**** Without IFRS16, in the 4Q2021 the Agora Group recorded EBITDA profit of PLN 49.9 million and EBIT of PLN 23.2 million, while the net profit stood at PLN 22.3 million.

Go back