August 13, 2021 / 15:21

The revival on the advertising market, the growing interest in the content and publications sold and the return to operation of the Helios cinemas provided the Agora Group with a dynamic increase in revenues in 2Q2021. The advertising sales of the Outdoor, the Press and the Radio segments grew faster than the market, and all of the Group's businesses improved their operating results. The profit at the EBITDA level recorded at the end of June this year is the beginning of rebuilding of the entire Agora Group’s results.

- In the 2Q2021, the Agora Group started making up for its COVID-19 losses. Thanks to the gradual lifting of restrictions and the reopening of another branches of the economy, almost all categories of our inflows grew rapidly, in all areas of our activity - comments Anna Kryńska-Goldewska, Member of the Management Board of Agora. - Importantly, recent months have brought very clear signals of the reconstruction of the advertising market in Poland, the value of which in the 1H2021 was higher not only than in 2020, but also in the record-breaking 2019. This provided the Agora Group with over 50% increase in advertising revenues in the past quarter. We are also very satisfied with the growing digital and internet sales in the Group, which cumulatively reach 40%, as well as the great restart of Helios cinemas. Although they opened their screening rooms on 21 May, they quickly gathered a large audience and have a strong repertoire offer, giving hope to accelerate the pace of revival of the cinema market.

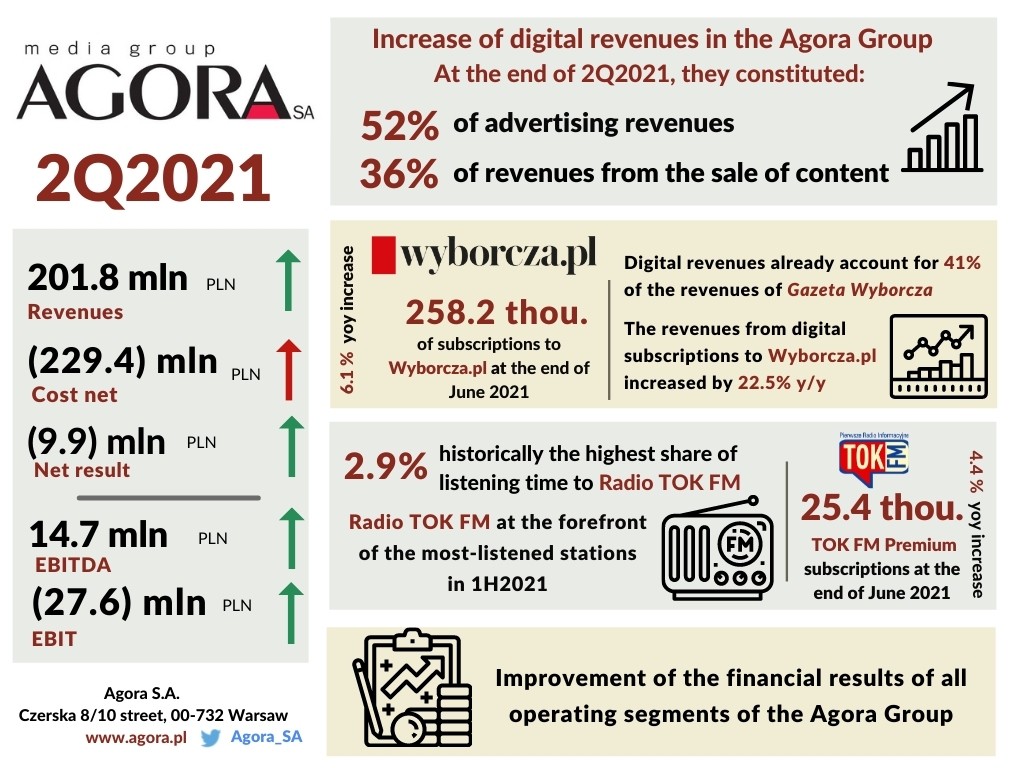

In the 2Q2021, the Agora Group’s total revenues amounted PLN 201.8 million and were higher by nearly 56.0% yoy.

The Group’s advertising revenues increased by 53.2% to PLN 118.4 million, growing in each of the business segments. This was due to the unfreezing of subsequent sectors of the economy, as well as greater advertising activity of entrepreneurs, which ensured a significant increase in the value of advertising spending in Poland in the 2Q2021 by 41.5% to the level of approximately PLN 2.7 billion1. The copy sales amounted to PLN 35.6 million and were higher than a year ago by almost 21.0%. The increase in this category was recorded both by the Agora Publishing House and Gazeta Wyborcza, while income from the sale of Wyborcza.pl content subscriptions grew by 22.5% thanks to the increasing average revenue from digital subscription. Total inflows of Gazeta Wyborcza from digital advertising and copy sales amounted to nearly PLN 16.3 million and accounted for almost 41.0% of its total revenues. Similarly, inflows from the digital operations of the Radio segment - internet advertising services and sales of Premium TOK FM subscriptions - increased by 49.0% in the 2Q2021. In total, the Group's digital advertising sales already account for almost 52.0% of its ad inflows, and the revenues from sale of digital content reach almost 36.0% of copy sales.

Thanks to the reopening of Helios cinemas on 21 May 2021, operating with specific restrictions, including a limit on the sale of seats in the screening rooms, the Agora Group recorded income from cinema activity in the 2Q2021. Almost 0.9 million tickets were sold in Helios cinemas, and revenues from this increased to PLN 16.5 million, while revenues from concession sales, relaunched on 13 June 2021, to PLN 5.3 million. Rapid growth was also recorded in the category of gastronomic sales - thanks to Step Inside, which runs 10 restaurants under the Pasibus brand. The inflows from other sales were also higher. The only revenue item that decreased compared to the 2Q2020 was income from the Group's film activities - mainly due to a lower number of productions in cinema and digital platform distribution.

Although in the 2Q2021, the Agora Group continued to operate in a strict cost discipline, its net operating costs increased by over 25.0% to PLN 229.4 million. The largest item among expenses were the staff costs, which amounted to PLN 76.4 million and were almost 45.0% higher yoy. This increase was primarily the result of last year's base - in the pandemic 2020, the Agora Group introduced, ia., 20.0% wage cut for six months. In other cost categories, their growth was related to the intensification of the Group's operations and had its impact on revenue growth.

It is also worth noting that a significant impact on the comparability of data yoy had a number of one-off events that took place in 2020. They charged the Agora Group's results with the total amount of PLN 7.5 million2, while the total cost of one-off events recorded in the 2Q2021 stood at PLN 2.4 million3.

Thanks to a significant increase in revenues from almost all sources, the Agora Group achieved a profit at the EBITDA level of PLN 14.7 million in the 2Q2021, which means a noticeable improvement compared to 2020. At the same time, the Group recorded a loss at the EBIT level of PLN 27,6 million and a net loss of PLN 9.9 million4.

- The results of the Agora Group from the 2Q2021, as well as the optimistic market situation allow us to believe that the dynamics of the Group's revenue growth in the coming quarters will increase with each period, of course, provided that the COVID-19 pandemic does not intensify again. This will be supported in particular by the significant revival on the advertising market – this is the reason why Agora has increased its estimates of the increase in advertising spending in Poland this year - adds Anna Kryńska-Goldewska.

As expected by the company, in 2021 advertisers will increase spending on the promotion of their goods and services by approximately 8.0-11.0% compared to 2020. The only segment of the advertising market which value will shrink throughout this year will be press published in the traditional form - the decrease may amount to 9.0-12.0% yoy. In cinemas, due to the longer than expected closure of cultural facilities, growth dynamics will be lower than originally forecasted and will amount to 6.0-9.0 %. At an unchanged level of 5.0-8.0% Agora estimates an increase in the value of advertising spending on television. On the other hand, a dynamic increase in the value of expenses will take place in the outdoor advertising segment - it may even reach 15.0-18.0%. According to the company's forecast, online advertising expenditure will increase by 9.0-12.0%, and on radio by 8.0-11.0%.

Data source: consolidated financial statements according to IFRS, 2Q2021.

Footnotes:

1 Advertising market - Agora's estimates (press based on Kantar Media and Agora's monitoring, radio based on Kantar Media), IGRZ (outdoor advertising, since January 2014 the number of entities reporting revenues to IGRZ has decreased), as well as preliminary data of Publicis Media (TV, cinema, internet).

2 The one-off events occured in 2Q2020: profit on the sale of a part of the Plan D enterprise (formerly Domiporta) in the amount of PLN 3.6 million and on the sale of real estate in the amount of PLN 0.4 million, as well as the costs of restructuring activities in Plan D and GoldenLine in the amount of PLN 1.4 million, a write-off of the value of assets in the AMS group, Foodio Concepts and one of the buildings after closed printing activity in the total amount of PLN 7.5 million.

3 In the 2Q2021, the operating costs of the Agora Group were charged with impairment losses on assets.

4 Without taking into account the impact of IFRS 16, in the 2Q2021, the Agora Group recorded an EBITDA profit of PLN 5.4 million, an EBIT loss of PLN 21.0 million and a net loss of PLN 15.4 million.

Go back