March 17, 2023 / 07:56

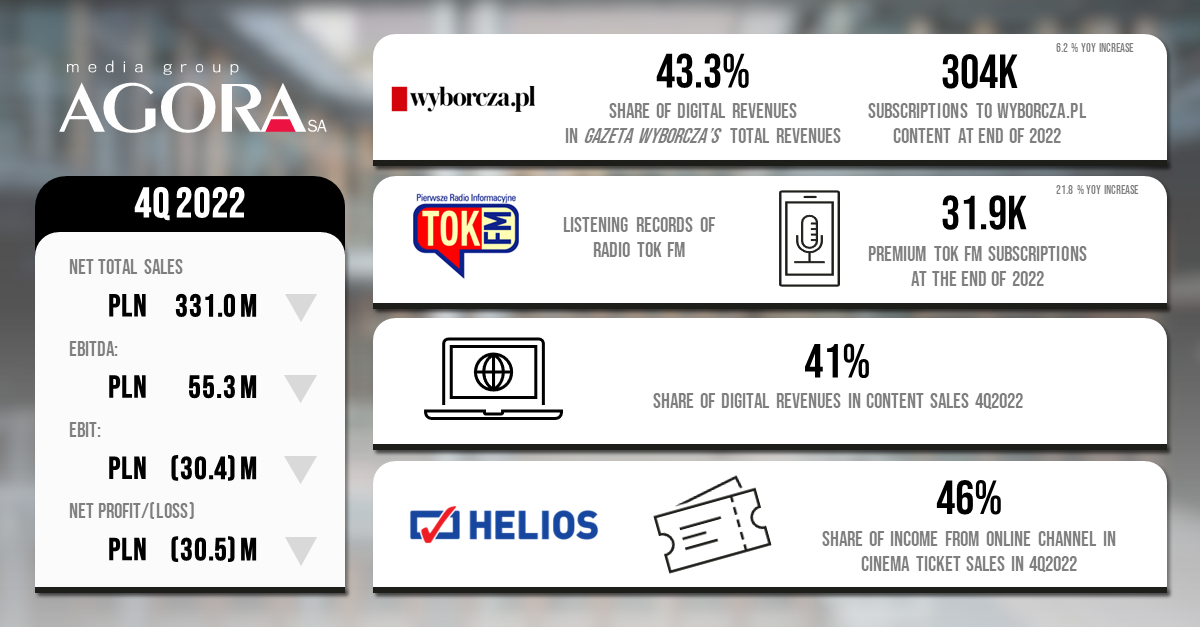

The Agora Group's performance in the 4Q2022 continued to be pressured by economic conditions and rising operating costs, which were further negatively impacted by non-recurring events. However, the Outdoor, the Radio, and the Movies and Books segments, as well as Gazeta.pl increased their advertising inflows. In addition, the Agora Group closed 2022 with historic levels of active subscriptions to Wyborcza.pl and TOK FM Premium, which allowed for increase in the Group’s digital content revenues.

- Despite a weaker 4Q and huge cost pressures, we ended 2022 with revenue growth and improved EBITDA. In the coming months, we want to focus on activities aimed at strengthening the entire Agora Group and consolidating its position as one of the strongest companies in the Polish media market. This is supported by a good start of the current year and the realization of the long-awaited investment in Eurozet - Agora's largest ever investment in the media sector. The decision of the company's shareholders on the planned reorganization of the capital group will also be an important factor in undertaking further development projects - says Bartosz Hojka, President of the Management Board of Agora.

In 4Q2022, the Agora Group's total revenues amounted to PLN 331.0 million, down by less than 6% yoy. The Group's inflows related to film and foodservice operations increased, but the growth in this area was offset by lower total advertising revenues, as well as income from cinema operations and copy sales.

The Group's advertising revenues decreased by almost 10% yoy to PLN 157.8 million. Advertising revenues increased in the Outdoor, the Radio, and the Movies and Books segments. In the first of these businesses, this was driven by growing spending on campaigns executed on citylight, digital and backlight panels, while in the second, it was driven by revenues from the sale of airtime of Agora's Radio Group stations, which noted a record total listenership share of almost 8% in 4Q20221. In cinemas, on the other hand, the increase in advertising revenues was mainly related to the absence of restrictions on their operations. On the other hand the Group recorded drop in advertising inflows in the Internet segment, which was impacted by lower revenue from the sale of advertising services in Yieldbird, with higher ad inflows of Gazeta.pl, as well as in the Digital and Printed Press. Digital and online inflows accounted for over 40% of the Agora Group's total advertising sales.

The Group’s copy sales in the last quarter of 2022 decreased by over 2% to PLN 38.6 million. Gazeta Wyborcza's inflows from the sale of digital subscriptions increased, while revenues from the sale of traditional editions declined - although the daily recorded higher average monthly copy sales in the period under review as compared to the previous 3Q20222. The team of the Digital and Printed Press segment achieved also another success in the area of digital subscriptions - Wyborcza.pl closed 2022 with the number of active subscriptions above 303.7 thousand, an increase of more than 6% compared to the end of 2021. By exceeding another level of sales, Wyborcza is not only the largest player on the Polish digital press market, but also one of the leading publishers on the European Union markets. It is also worth noting the success of Radio TOK FM's subscription offer, which exceeded another sales level already in October 2022, with the number of sold Premium TOK FM accesses reaching almost 31.9 thousand by the end of 2022. The share of digital revenues in the total inflows from the sale of the Group's publications increased to almost 38%, and the entire sales of digital content is also growing dynamically - its share amounted to nearly 39%.

Revenues from ticket sales in the Helios cinema network decreased by over 9% to PLN 58.0 million, and income from concession sales - by more than 1% to PLN 30.8 million. In the period under review, 3.0 million tickets were sold in Helios cinemas, almost 12% less than in 4Q2021. In the entire cinema market, 11.9 million tickets were purchased in this period, as compared to 14.7 million tickets a year earlier, a decrease of 19%3.

Inflows from other sales were at a similar level as a year ago, while the Agora Group recorded an increase in revenues from foodservice operations - to PLN 10.3 million and from film business - to PLN 8.0 million. In the first case, this was related to the increase in revenue of the Step Inside company recorded in the absence of restrictions on its operations and thanks to a higher number of restaurants, while in the second case it was particularly related to the cinema success of the film Johnny, about the friendship between the priest Jan Kaczkowski and Patryk Galewski, directed by Daniel Jaroszek, which had an audience of almost one million viewers by the end of 2022. NEXT FILM's second self-produced title was also recognized with numerous awards and nominations, and in addition, Johnny's result contributed to NEXT FILM's record-breaking performance throughout the year – movies distributed by the company attracted almost 2.7 million viewers in 2022, giving it a historic 32% share of the Polish film distribution market and a position as its leader4.

The Agora Group's net operating costs in 4Q2022 increased by more than 10% to PLN 361.4 million. They were higher in all businesses, except for Internet. The increase in the Group's expenses was driven by market conditions, related to general price increases, inflation and wage pressure. Importantly, operating expenses were significantly impacted by asset impairment charges of PLN 47.2 million, made mainly in the Digital and Printed Press, as well as restructuring costs in the press and cinema business totaling PLN 5.3 million and a write-down of receivables from one of the contractors of the Outdoor segment of PLN 1.1 million5.

Costs of third-party services were the Group’s largest cost item - lower in 4Q2022 compared with the same period in 2021, while expenses on consumption of materials and energy and value of goods and materials sold increased the most. Staff costs grew in almost all operating segments. At the end of December 2022, the Agora Group's employee headcount stood at 2 339 FTEs, up by 16 FTEs yoy.

Ultimately, in 4Q2022 the Agora Group recorded an EBITDA profit of PLN 55.3 million. EBIT loss amounted to PLN 30.4 million, net loss amounted to PLN 30.5 million and net loss attributable to shareholders of the parent company amounted to PLN 31.4 million6. However, it should be remembered that these results were negatively affected by the one-off events described above.

According to Agora's estimates, the advertising market in Poland grew by almost 4% in the 4Q2022, and advertisers spent around PLN 3.42 billion on promoting their products and services. Throughout 2022, the value of the advertising market was approximately PLN 11.1 billion, and the growth rate was 4.5% yoy, i.e. it reached the level anticipated in the company's assumptions. After analyzing the data and observing market trends, the Management Board of Agora estimates that the dynamics of advertising spending in Poland in 2023 will be around 2-4% - despite the high uncertainty regarding the scale of the economic slowdown in the country, the level of inflation and operating costs of companies, as well as the situation in the region, this may be rather closer to the upper limit of the indicated range.

The beginning of 2023 brought an important conclusion for the Agora Group - after a 4-year of administrative and legal battle, the court of 2nd instance dismissed the appeal of the President of The Office of Competition and Consumer Protection, who had prohibited the company from acquiring Eurozet. As a result, Agora finalized its largest ever investment in the media and became the owner of a controlling stake in Eurozet, and at the same time the 2nd largest broadcaster in Poland.

While planning intensive development of the radio offer - with the Radio segment as the largest media business, Agora's Management Board will focus on operating as efficiently as possible and ensuring growth of the entire organization. To this end, a project of spinning off companies from Agora S.A. has been developed and submitted to a vote of shareholders.

At the same time, Agora's Management Board focuses on the sustainable development of the entire organization, for which social commitment and responsibility are an important part of the business. One can additionally read about projects and successes in this area, as well as plans, in the Agora Group's ESG report for 2022.

Data source: consolidated financial statements of the Agora Group for 4Q2022 according to IFRS.

Footnotes:

1 Radio Track survey, Kantar Polska, October-December 2022, indicator: share of listening time (%).

2 PBC data on daily newspaper sales, February 2023.

3 Cinema attendance - Helios S.A. estimates, based on Boxoffice.pl data from film copy distributors and on UIP distributor's film scores obtained at multiplex networks.

4 Attendance for Johnny and all productions distributed by NEXT FILM by the end of 2022 - company's own data; Polish film distribution market data - based on Boxoffice of Polish films.

5 Costs of non-recurring events from 4Q2021 charged to the Agora Group's operating costs in the amount of PLN 2.7 million (asset write-offs, recognition of an impairment loss on receivables of one of the contractors and a subsidy from the National Film Institute).

6 Excluding the impact of IFRS 16 in 4Q2022, the Agora Group recorded a profit on the EBITDA level of PLN 31.6 million and EBIT loss amounted to PLN 36.9 million.

Go back